|

|

Project Overview

ING Direct Australia recognised that their customers were rapidly embracing mobile. Their existing web-based app experience wasn’t delivering the user experience or features their customers wanted. So, in June, ING Direct Australia responded to the mobile banking needs of customers by launching a brand-new native app that our customers helped design. Because of this input, we now have the highest rated mobile banking app in Australia.

Organisation

Team

This project was a collaborative effort between ING DIRECT internal digital and IT staff with initial designs and creative developed by Deloitte Digital and IT development support provided by Oakton. The project set out to deliver a new native mobile app for both iOS and Android as well as a supportive API infrastructure to support the mobile app and future digital initiatives.

Project Brief

Customer adoption of mobile banking in Australia has been breathtaking. In the last 12 months alone, ING DIRECT has seen mobile traffic grow by 280%, reaching a point where over 39% of customer transactions occurred via mobile devices.

Despite this, the mobile experience we offered our customers was poor. Our app had limited functionality, slow response times, ad hoc performance levels, and an interface that was difficult for customers to use and to navigate. Our internal technical constraints made fixing any issues a slow and expensive exercise, resulting in our app being updated only twice in the three years it was in market. Our customers didn’t like this, regularly providing negative reviews and rating our app only 2.5 stars – the lowest of any bank in Australia.

These challenges presented a great opportunity to:

• Design a mobile experience that customers would be delighted with focusing on the user experience and app performance

• Design an app with security at its core but minimising the intrusion to customers as we know the largest barrier to mobile banking adoption is security perception.

• Build a technology foundation that would allow low cost, regular improvements to mobile and other channels

Project Need

These challenges were solved through the delivery of a new native mobile and an API that enables regular enhancements to be made in a timely cost effective way.

There were three defining characteristics we took to enhance the user’s experience:

1. Customers were involved in the design of the app. Initial customer research tightly focussed our efforts on the real needs of customers within the mobile context – not what we thought they needed. In fact, it resulted in us reducing some planned functionality for the first release, and heightening our focus on the aesthetic design and interaction. It showed that simplicity and intuitiveness was important and features like seeing you balance before logging in if you choose or notifying someone of a payment were convenient for customers. Ongoing customer testing, throughout the design and build process, allowed us to respond to customer direction by refining designs.

2. The project was driven by Usability experts: Doing it this way, rather than a traditional Project-Manager-Led approach, meant that customers and their needs were kept at the heart of all project decisions. It also meant that the “softer” aspects of design, such as look and feel, swipe speed and the like which add value, weren’t neglected.

3. It was a joint collaboration between Digital and Technology teams: Working collaboratively provided a lot of diversity which helped when problem solving. It meant the architecture of the app was designed with speed and security as the main requirements.

User Experience

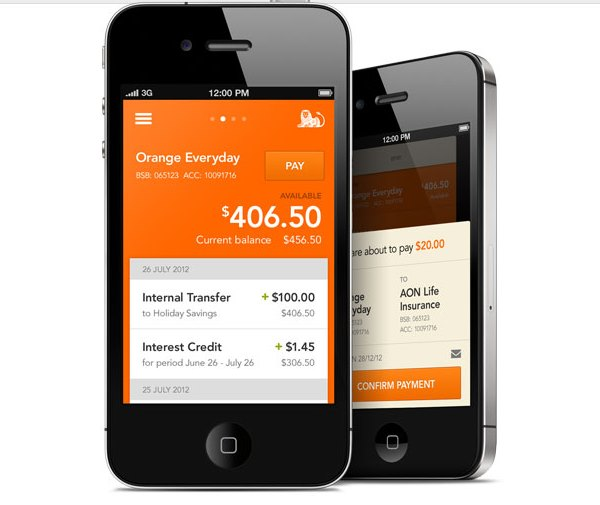

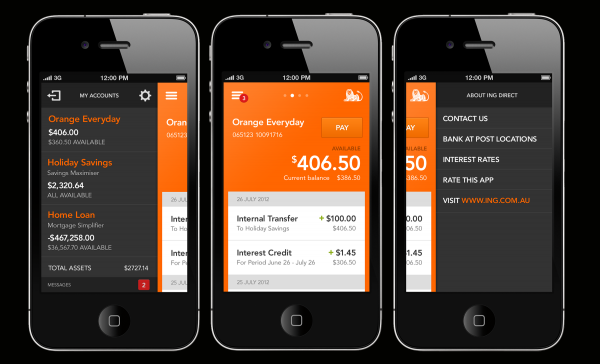

The team set out to create an experience that was clean, open, approachable, invigorating and minimalist. The user experience focused on transparency – getting out of the way and giving users fast and clear access to the information they need.

In doing this we created an interface completely different to the tab bar approach so widely used by other banks. Instead, we make the most of every bit of the mobile screen by relying on simple gestures and minimalist navigation.

Our customers have appreciated this approach with comments on the app stores and social media such as:

• “All new features are excellent and user friendly. Internet Banking made easier than before.”

• “Congratulations ING Direct on the best version upgrade (v2) I've ever seen. It's so much faster, clearer, easier to use, & beautifully designed. One if the best banking apps available. You have done yourselves proud!.”

• “Very happy customer, the new app is so user friendly, easy to read and navigate, worthy of 5 stars!!!”

• “I've never rated an app before but this is fantastic. It's how a user would set it out, rather than how a bank would set it out.”

• “As far as banking apps go you can't get much better then ING Direct.”

• “Fast, responsive, a million times better than the old app.”

Project Marketing

The key elements that make the marketing of the mobile app engaging to our customers are the same things that they find appealing about ING DIRECT, simplicity, relevance and transparency. As the app is mainly for our existing customers our goal was to get existing customers with the app to upgrade and entice customers who haven’t downloaded the app to start using mobile banking.

We did this right from get go, by generating interest and offering customers the opportunity to be the first ones to know about the app, by registering their interest so we could send them a SMS when the app was available.

We planned the marketing of the mobile to be contextual and relevant to the customer. We didn’t do mass-media approach but targeted the communication to each specific customer segment showing how mobile banking enhanced relatable experiences based on products they actually hold.

In order to really engage the customer, you really have to show them how it works – so we created short, sharp interactive demos to give them a flavour of the functionality and ease of use. We also used the opportunity, via social media, to respond to highly engaged customers who left previous comments about our app or needed clarification.

Engagement is all about results, we have had over 170,000 downloads in the first 4 weeks of the app being in market which is more than our old app received after 3 years.

Financial Information & Tools

This category relates to applications that provide financial information and tools.

More Details